So, you’re thinking about selecting an expensive timepiece, right? the Swiss brand is usually the top pick that comes up for enthusiasts and individuals who invest in high-end items. Now, whether a the Swiss brand is a wise investment or not—people have been talking about this for ages. So, what we’re gonna do here is explore five prominent motivations people are into the Swiss brand as an investment, and give you some ideas on what makes them valuable.

Number one on our list: It’s all about history. Rolex has a really cool past.

Next up: Reputation and holding onto value. This is a big one.

Third up: Demand and the potential to make some money. Big deal.

Fourth on our list: condition and the real deal. This is important.

Last but not least: trends and the economy. It’s all tied together.

Alright, if you want to dive deeper, here are some reads:

Number one on our list: It’s all about history. Rolex has a really cool past.

Rolex has been around since 1905. Talk about a brand with some serious street cred! They are recognized for their quality, excellent craftsmanship, and that whole elegant atmosphere.

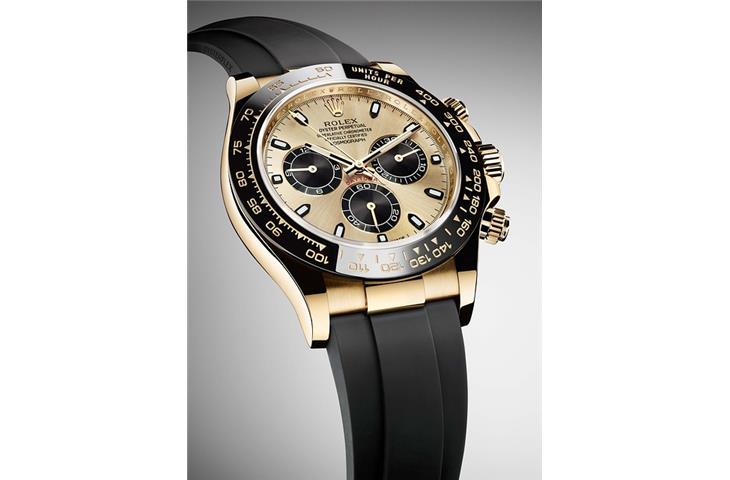

And its timeless design? That alone makes it a really appealing investment for anyone who’s a fan of a good brand narrative. And don’t forget about the scarcity factor. Stuff like the Sub or the Daytona Rolex? They don’t grow on trees, and that’s part of why they’re valuable.

Next up: Reputation and holding onto value. This is a big one.

Brand? They’re like the top-tier of watches. Their reputation draws people in, and that’s why their watches retain value so well.

Folks who have one of these watches often see them getting more expensive as the time passes. That’s one good investment, for sure. They’re constantly innovating, and they’re performing well. That’s why these watches are popular among collectors.

Third up: Demand and the potential to make some money. Big deal.

People are always wanting more brand, and it’s obvious reason. They’re rare, not mass-produced, and come with that whole prestige. Because of all this demand, these watches can command a high price than you paid for them. That makes it a good investment opportunity if you’re looking to invest. And hey, you can trade these watches almost anywhere these days, thanks to auction houses and online platforms. That makes investing inbrand a whole lot easier.

Fourth on our list: condition and the real deal. This is important.

When you’re looking to Investment, the State and if it’s the authentic item are huge. A timepiece that’s been well-maintained and is legit is going to retain its worth better and attract potential buyers.

You gotta Conduct thorough research, folks. If you’re thinking about buying one of these, make sure it’s in good shape and comes with all the official documents. Look out for signs of use, check the model number, and make sure it’s not a fake. These are the basics of doing your due care.

Last but not least: trends and the economy. It’s all tied together.

You need to keep an eye on market movements and Economic aspects if you want to make witty choices about Investmenting in Rolex watches. Economic aspects, like currency stability, how different currencies interact, and what customer preferences, all influence how much a Rolex watches is worth. Remain informed about what’s happening and adjust your plan if you need to. It’s all about playing the game smart.

Alright, if you want to dive deeper, here are some reads:

1. Take a examination at ‘Rolex: A Dedication to Excellence’ written written by Hans Wilsdorf